car perks cheaper cars insurance

car perks cheaper cars insurance

On the other hand, a motorist with a bad driving record need to choose for a lower insurance deductible. In addition, countless states have actually made driving documents readily available online.

Going with the ideal insurance deductible amount, relying on your demands and also financial situation, can aid you conserve hundreds on your auto insurance coverage (prices). If you choose in between a car insurance deductible of 500 or 1000, take into consideration numerous factors highlighted in this short article and review your choices with your insurance coverage agent (accident).

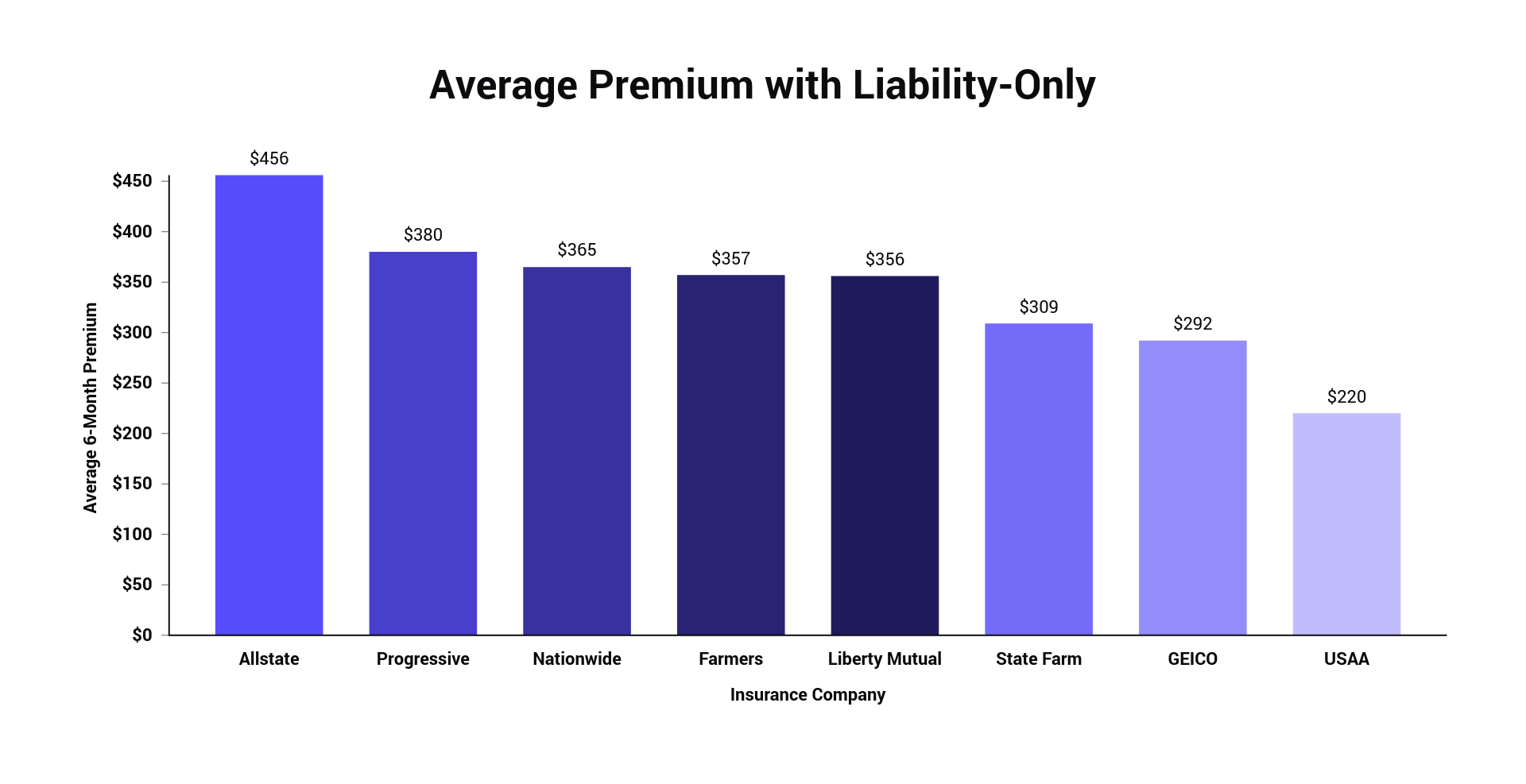

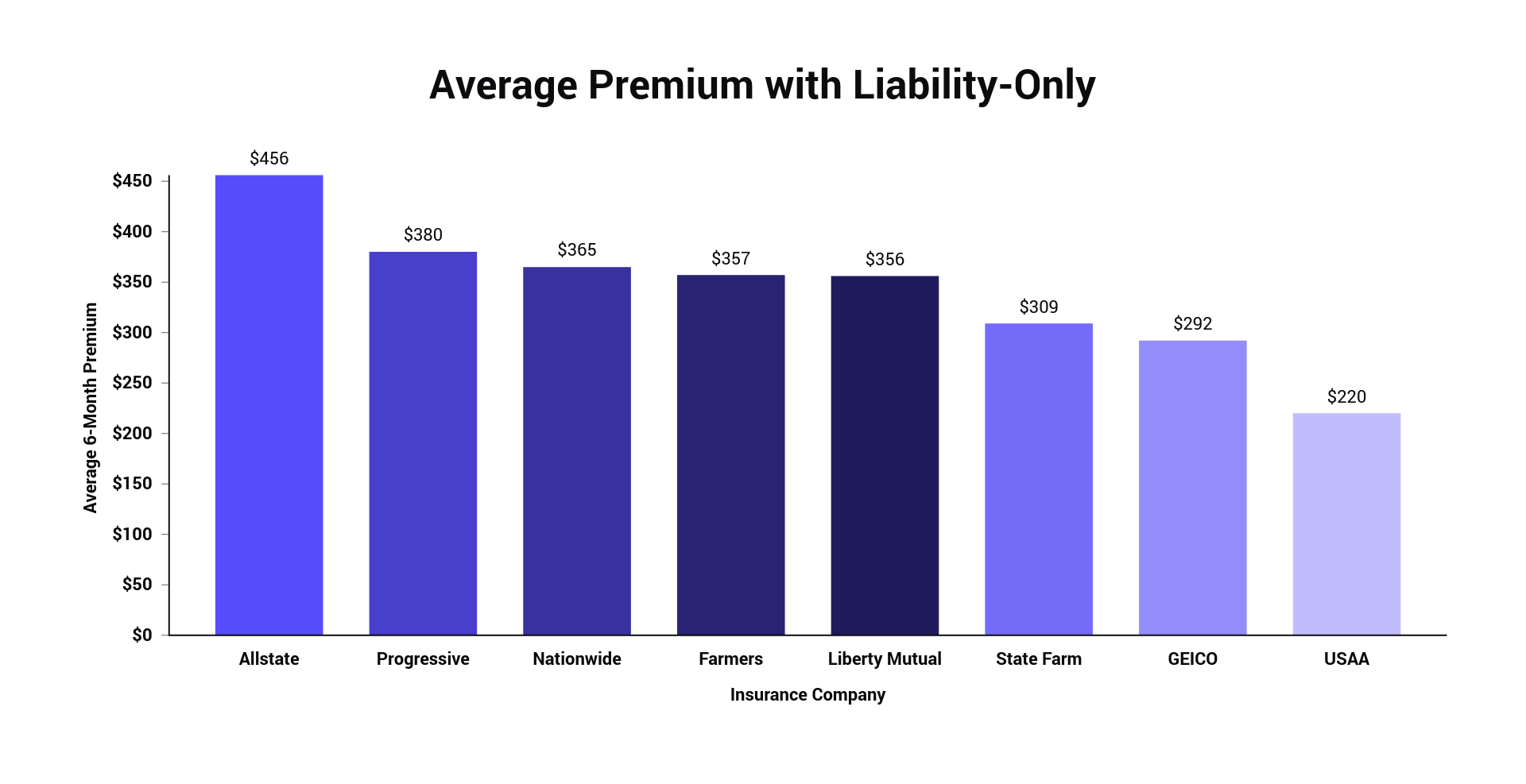

low cost insurance company insurance company cheapest car

low cost insurance company insurance company cheapest car

Rather, do appropriate study as there are various other means to reduce insurance coverage premiums. What is better: a greater or reduced deductible for automobile insurance policy?

What is the most effective collision insurance deductible? It's finest to have a $500 crash deductible get more info unless you have a large amount of savings. auto insurance. Remember, this deductible amount needs to be paid each time you make a collision insurance claim - affordable auto insurance. What is the disadvantage of having a higher deductible? A major con of a higher deductible is that you might not be able to pay for a larger loss.

You may have wondered previously, exactly how do insurance coverage deductibles function? What are the different kinds of deductibles, and also does the amount influence the monthly settlements? In straightforward terms, an insurance deductible is the amount of cash you commit to pay out of pocket before your insurer begins to pay you any advantages - car (insurers) (car insurance).

Comprehensive Car Insurance: Do You Need It? - Nerdwallet Fundamentals Explained

: State you have a deductible of $500 and also you rear end somebody. If you are the at-fault chauffeur, the coverage will have to originate from your collision plan - business insurance. If your damages are $2000, you will certainly have to pay the $500 insurance deductible and after that your insurance coverage will certainly pay the remaining $1500 (car insurance).

You would pay the full $400 and also your insurance would not pay anything, since you did not get to the deductible. Various kinds of deductibles: A deductible can be a set amount or a portion of the total price of your case.

If you select a higher deductible your premium rate will be lower - suvs. Just remember, if you select a high insurance deductible, you require to have at the very least that much cash saved in situation you enter into a crash and also have to pay it. perks. Where to locate your insurance deductible: If you already have an insurance coverage policy, you can discover the amount of your deductible on the main web page of your policy, referred to as the (cheaper cars).

auto insurance dui car affordable

auto insurance dui car affordable

It is near the front of your plan. credit. Examine to see what your insurance deductible is, and if you have any type of trouble locating it or any kind of other concerns whatsoever, call an Infinity agent at! - cheaper auto insurance.

automobile cheaper auto insurance prices affordable auto insurance

automobile cheaper auto insurance prices affordable auto insurance

What is an insurance deductible? An insurance deductible is the amount of cash you have to pay from your very own pocket before your insurance policy protection kicks in. laws.